A Strategic Reflection on Ilya Sutskever’s "Age of Research"

The real estate industry has a favorite villain: "The Environment."

Ask any developer why we have a housing crisis, and they will (rightfully) point to the math. Municipal fees now eat up to 30-40% of project costs. Approvals take 4-6 years. We are trapped in a high-cost, high-friction environment that makes it nearly impossible to build affordable homes.

The consensus is clear: If the government just got out of the way and capital was cheap again, we would solve this.

But last week, Ilya Sutskever (co-founder of OpenAI) asked a question that challenges this entire assumption. Speaking about the limits of scaling in AI, he asked:

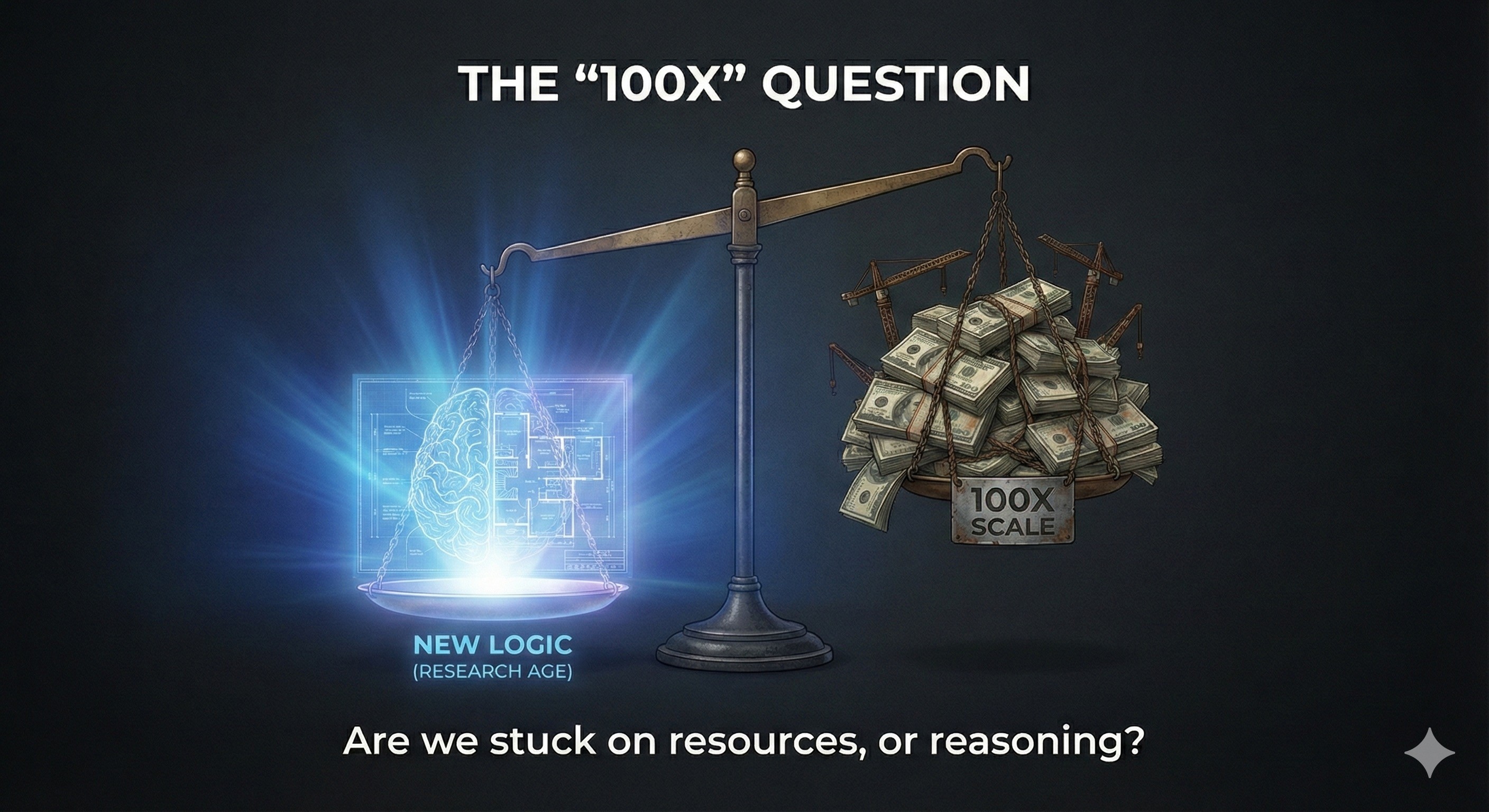

"Is the belief really that if you had 100x more [resources], it would be so different? ... Is the belief that if you 100x the scale, everything will be transformed?"

He was questioning the industry's internal logic. And we need to ask ourselves the same uncomfortable question.

If we had 100x the capital and zero red tape, would we actually solve the housing crisis?

The honest answer is No. We would just build 100x more of the same speculative, high-leverage inventory.

The Merchant Builder's "Source Code"

For decades, the development industry has operated on a specific algorithm: The Pro-Forma.

This algorithm doesn't optimize for "housing humans." It optimizes for "Return on Cost" (ROC) and "Internal Rate of Return" (IRR).

We don't build what society needs (affordable family housing); we build what the spreadsheet rewards (luxury condos with high price-per-square-foot).

We rely on the housing shortage to keep prices high.

We rely on "trading work for money"—outsourcing the risk, collecting the fee, and moving to the next deal.

We are like the AI models Ilya critiques: we are "overfitting" for the wrong goal. We are optimizing for the transaction, not the outcome.

The "Oxygen" of Crisis

Here is the paradox: The current industry model depends on the crisis to survive.

When supply is low, prices rise, and our margins look good. If we actually "solved" the crisis—if we flooded the market with affordable, abundant homes—prices would stabilize or drop. The "Merchant Builder" model, which relies on constant appreciation to cover high interest and construction costs, would collapse.

So, if we had 100x the resources, we wouldn't use it to lower prices. We would use it to increase leverage. We would build bigger, riskier towers to chase even higher yields.

We wouldn't fix the machine; we would just run it faster.

The "Age of Research" for Real Estate

Ilya argues that when "scaling" (doing more of the same) hits a wall, you must enter the Age of Research. You have to change the underlying logic of the system.

For real estate, this means we have to stop asking, "How do I survive these costs?" and start asking, "Is my product actually useful?"

The developers who survive the next decade won't be the ones who just wait for interest rates to drop. They will be the ones who rewrite their source code.

From: "How do I extract the most value from this land?"

To: "How do I generate the most value for this community?"

It is valid to be angry at government inefficiencies. The 40% soft costs are real, and they are painful.

But we cannot let that be our only story. We cannot pretend that "cheap money," is a moral victory.

As Ilya warns, 100x the scale will not transform a flawed system. It will only reveal its cracks. The next era belongs to the builders who stop optimizing for the deal and start optimizing for the human.

The Question: If costs went to zero tomorrow, would you build a different product? Or just a more profitable version of the same mistake?